Table of Contents

Introduction

A new product development (NPD) research programme is a pre-requisite for the successful development of new products and services. Within that programme, it is also essential that the most appropriate research approach is selected at each stage. In this article we consider this issue in detail, and specifically, whether it is more appropriate to use a sequential or monadic concept evaluation approach.

High rates of new product failure

The development of a new product or service concept is a hugely important and exciting time for any business.

However, there are several points within the new product development process when things can quickly go off track if the wrong decisions are made.

No wonder then, that according to Harvard Business School professor Clayton Christensen, over 30,000 new, packaged consumer products are launched every year, and 4 out of 5 fail!

It’s easy to suppose that most of these failures are down to ‘hobbyists’ – Dragon’s Den-type individuals who develop new product ideas in their spare time.

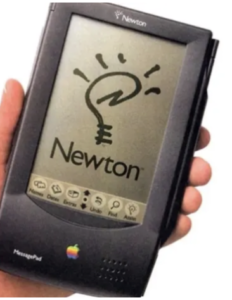

However, the majority are actually launched by large companies. Some of the world’s best-known organisations, including Apple, Nintendo, Samsung, Coca Cola and Colgate have launched some absolute stinkers that had to be quickly withdrawn.

Apple’s Newton PDA. Launched 1992. Discontinued 1998

Built-in new product failure

New product launches frequently fail as a result of the individual or organisation opting to pursue a development process driven by gutfeel instead of rigour.

When this happens, it’s often because the new product development team is so convinced by its own new product vision that it fails to acknowledge the need to develop and test alternative concepts alongside it, often citing time and budgetary reasons.

Maximising the chance of new product success

Based on our experience of having helped to many successfully to market, we find that the chance of launch success is dramatically increased if the new product development team;

- Doesn’t put all its faith in just one concept, but instead progresses with a number of concept candidates at the outset. These concepts may be different in kind, or different expressions of the same, big idea.

When this is the case, even if the concept favoured by the development team ends up being the one that is ultimately selected for launch, it will have benefited enormously from the learning provided by the other concepts along the way.

- Includes market research at key stages of a stop / go, gated development process – if only to challenge internal preconceptions.

The benefits of a market research-led new product development process

A properly integrated programme of market research will ultimately enable the new product development team to identify:

- The ‘must succeed with’ target audience(s)

- The target audience needs, attitudes and behaviours that must be addressed

- The concept’s commercial potential

- The strengths and weaknesses of the preferred concept candidate, and the extent to which any weaknesses can be overcome

- Key competitors, and their own, perceived strengths and weaknesses

- The optimal price point for the new product or service

- Potential sales volumes

- Branding and packaging pre-requisites

Different types of new product development research

There are two main types of new product development research – qualitative and quantitative – and each has its place within the development process.

Qualitative research is more exploratory in nature and is typically used towards the beginning of the new product development process, to identify the ‘unknowns’ in relation to the target audience, and to generate initial hypotheses relating to the new concept(s) that can be substantiated through quantitative research.

It may involve interviews, focus groups, co-creation or ethnographic studies.

Quantitative research is typically used to map the market landscape, substantiate key findings from the qualitative research and identify the concept(s) with the greatest commercial potential.

It is most often undertaken in the form of surveys, which may be completed online or face-to-face, sometimes in the form of hall tests.

Concept Testing

There are 2 different approaches for concept testing:

- Monadic

- Sequential monadic

Both have different strengths and weaknesses, and it is important to be clear about these before deciding on which testing approach to take.

Scenario

Imagine a chocolate bar manufacturer wishes to test 4 new chocolate bar concepts, in order to identify the one with the greatest potential for launch.

Concept testing could be undertaken using either qualitative or quantitative research – or a combination of the two.

In addition, testing could be undertaken using either a monadic approach, or a sequential monadic one.

However, the results would provide very different levels of insight and understanding.

Monadic vs sequential monadic concept testing

Monadic concept testing

To recap, In the case of monadic testing, each member of the sample is exposed to just one of the new concepts – and a single set of common questions.

Of course, with 4 chocolate bars to test, this means that 4 matching samples (or ‘sets’ of research participants) are required.

The questions that are asked of each sample set in relation to each bar must be exactly the same – and asked in exactly the same way and order.

The test provides an absolute, rather than relative evaluation of each concept. As an outcome, comparable analysis of the data between the 4 sample sets can reliably determine overall preference, as well as provide rich diagnostic feedback on each.

Advantages of monadic concept testing

This is the purer, more realistic approach. After all, how often does a person eat more than one type of chocolate bar in one sitting!

Additionally, with only one bar being evaluated by each person:

- There is no order bias

- There is more time to deep-dive on the reactions to that bar – to find out why individual respondents have reacted as they have, how the concept can be improved, and so on.

- There is less chance of respondent fatigue, that could lead to a lack of concentration, or ‘speeding’, whereby respondents start rushing their answers, in order to get to the end of the test

Disadvantages of monadic concept testing

A far larger, overall sample is required. In this example it would be 4 times larger for the monadic test than a sequential monadic approach, assuming that in the latter approach each respondent tests all 4 chocolate bars.

The monadic test is also likely to take longer to complete, because of the number of matching samples and testing sessions that are required.

Sequential monadic concept testing

In the case of the sequential monadic concept testing approach, either the whole respondent sample is exposed to all the concepts, or different subsets of the respondent sample are exposed to different subsets of the stimulus material.

In the case of our chocolate bar concept test, the approach would mean that either the whole sample tests all 4 chocolate bars, or the total sample is divided in two, and each subset tests two bars.

Advantages of Sequential Monadic Concept Testing

The approach would result in a relative, rather than absolute evaluation of each concept, enabling us to determine which bar is preferred.

And, because sequential monadic testing typically involves smaller sample sizes overall, this can make the approach both more cost effective and faster.

Disadvantages of sequential monadic concept testing

On the other hand, with 4 bars to test instead of just one, there is far less time to gain wider contextual insights in relation to each one.

Another issue is that sequential monadic testing can give rise to concerns about order bias and respondent desensitisation as a result of being exposed to more than one concept.

Concept testing – In summary

- Don’t attempt to conduct new product development and concept evaluation on a shoestring budget. Essential steps (and insights) will be missed, and they will prove very costly in the long run

- Don’t take shortcuts based on gut feel or belief in a particular concept – subjectivity is anathema to successful concept development

- Bring your target audience into the development process as early as possible, to ensure you are developing something for which addresses real, unmet need

- Don’t put all your eggs in one basket – start with 2 or more concepts at the outset and let the process whittle them down

- Typically, sequential monadic testing is best to screen early ideas and separate the good from the bad

- Monadic testing is best for evaluating product performance and is best deployed later in the testing process and/or when more of a ‘scientific’ approach is required.

- When evaluating concepts quantitatively, decide which testing approach is going to work best.