Photo byPeter Bond onUnsplash

In this article

Covid-19 has had a huge impact on consumer behaviour across the board, affecting almost every aspect of our daily lives.

One of the areas where this is most striking is our changing attitude to food and drink.

Many consumers are looking to create a healthier and more environmentally conscious lifestyle in the wake of the pandemic, and there are a number of food and beverage trends that reflect these core motivations. From an increased demand for immunity-boosting products to the exponential growth of the alternative milk industry, consumer behaviour and attitudes are changing at a rapid pace.

In order to stay ahead of the game, it’s essential for brand owners to have their finger on the pulse. A deep understanding of consumer motivations is key, and will enable companies to anticipate which products and marketing campaigns will resonate with their target audience.

In this article, we take a look at five key food and drink trends in 2021 and how some well-known brands are using them to drive sales.

1. Immunity-Boosting Food and Drink Products

As a result of the pandemic, consumers are increasingly anxious about their health and are seeking products that claim to support their immune health. According to Google Trends there was a 670% increase in searches for ‘food’ and ‘immune system’ between February and March 2021, and this trend is showing no signs of slowing down.

Products incorporating vitamins C, D and zinc are particularly popular, since they are reported to boost our natural immunity. Many well-known brands are taking note of this trend; tea giant Tetley has recently launched a Super Green Immune tea with added Vitamin C, and plenty more brands are set to follow.

Consumers are also on the lookout for functional foods, which are defined as foods that offer health benefits in addition to their basic nutritional function. Examples of functional foods include turmeric and ginger, and products containing these ingredients are increasingly sought after.

Although immunity is likely to become less of an immediate concern as the pandemic subsides, consumers will remain receptive to products that are easy to incorporate into their lives and promote a healthier way of living.

2. The Plant-Based Revolution

As many consumers seek a healthier and more sustainable lifestyle, sales of plant-based products are booming. By the summer of 2020 plant-based food sales had seen a 243% rise, with consumers choosing 14% more meat and dairy-free products than the previous year.

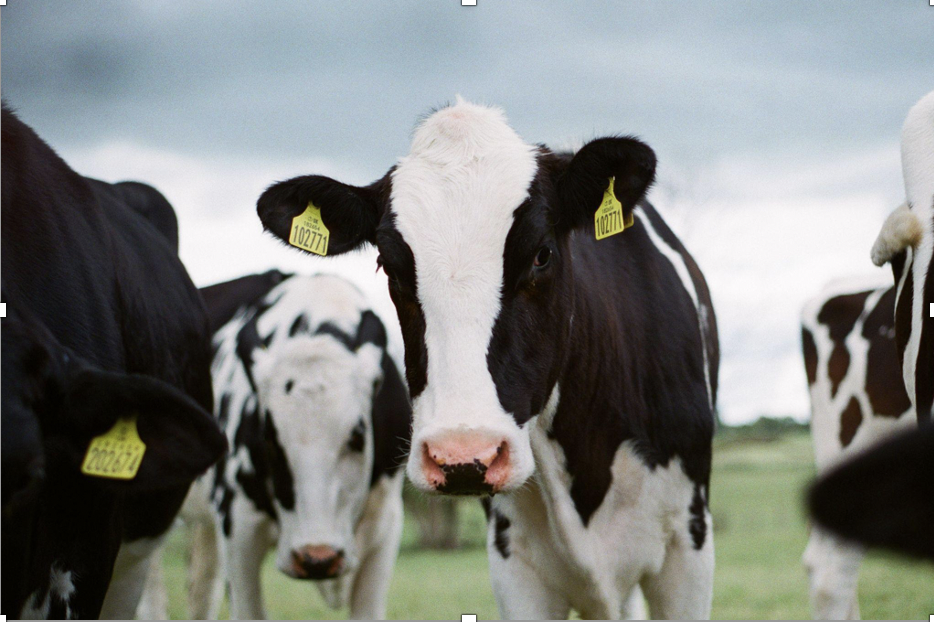

The impact on the dairy industry is particularly striking, with one in three UK consumers now buying plant-based milk. The data shows that the younger the consumer, the more likely they are to turn away from cow’s milk, with 37% of Gen Z consumers reducing their cow’s milk intake for health reasons. Other motivations for dairy avoidance include concern for animal welfare and environmental issues, with 36% of 16-24s agreeing that dairy farming has a negative impact on the environment due to CO2 emissions.

For the dairy industry to survive, it will be critical to reassure Gen Z (as well as other key consumer groups) about its high standard of animal welfare and the steps the dairy industry is taking to reduce CO2 emissions.

To demonstrate their commitment to the environment, 40 leading dairy organisations have recently declared their support for Pathways to Dairy Net Zero, a new climate initiative that aims to reduce the sector’s greenhouse gas emissions. Supporting companies include some of the biggest players in the industry such as Nestlé, Danone, and Dairy UK, and initiatives like this are vital to retaining the trust of consumers in 2021 and beyond.

3. ‘No to Low’ Alcohol Drinks (NOLO)

With reports suggesting that over 25% of 16-24 year olds in the UK identify as non-drinkers, consumer attitudes to alcohol are changing dramatically. Gen Z has even been dubbed ‘the Sober Generation’, with health as the number one reason for moderation.

And they’re not only concerned about physical health – research shows that 86% of the Millennial Gen Z population value mental health just as highly. By offering drinks that consumers can enjoy without the negative impacts of alcohol, brand owners can take advantage of this growing market.

Household names such as Guinness, Heineken and Budweiser have all launched zero-alcohol beers, and many smaller brands such as Caleño are paving the way for non-alcoholic spirits.

And it’s not just the younger generation that are interested in no/low alcohol alternatives. One in three adults are now moderating their alcohol consumption, and the desire for a healthier lifestyle is the driving factor.

Although there is still a large market for alcoholic beverages, brands will need to be more creative to appeal to consumers in the wake of Covid. Beer brands may be able to tap into their consumers’ desire for healthier, more functional products by highlighting the B vitamins present in their drinks or offering low-calorie varieties.

Other brands such as NIO are responding to the consumer trend for drinking at home by offering a service that delivers pre-made cocktails straight to your door.

4. CBD Food and Beverage Products

One of the fastest growing food and drink trends in the UK is CBD products. The UK is now the world’s second largest consumer cannabinoids (CBD) market, with sales of CBD products valued at £690m in 2021 alone. This figure is almost four times higher than predicted, demonstrating the unexpectedly rapid growth of the sector.

The increasing popularity of CBD supplements, oils, drinks and food products reflects the consumer desire to improve their physical and mental wellbeing, with the products reported to relieve anxiety and stress as well as physical pain.

CBD was declared a novel food in 2019 in the UK and Europe, meaning it can legally be sold as a food product if it is authorised by the FSA. A number of smaller UK brands are working with CBD in innovative ways to produce products such as CBD hummus, snack bars and even tonic water. Most of these products are sold largely online, although it’s likely that they will become available in stores as their popularity increases.

Many global brands are also planning to develop CBD food products, although progress is currently stalling because US regulators do not recognise it as a novel food. Ben & Jerry’s released a statement confirming their interest in creating CBD ice cream, and food giant Nestlé has launched some (non-food) CBD products on the US market under Garden of Life, a brand that they own.

5. Enhanced Transparency

Transparency is one of the most significant global food and drink trends of 2021, with six in ten consumers saying that they are interested in learning more about where their food comes from. In an age where consumers are used to having a wealth of information at their fingertips, they want to know where their food was produced, who grew it, how it was transported and what’s in it.

This demand for transparency has arisen in part due to a growing distrust of the ethics of large brands. There are a number of reasons for this lack of trust, including food safety issues and finding out about questionable food production practices, animal welfare and treatment of workers.

In an effort to regain consumer trust, many brands are implementing blockchain technology to enable consumers to track the journey of their product ‘from farm to fork.’ In 2017, Cargill (America’s largest privately owned company) introduced blockchain technology so that customers could trace their Thanksgiving turkey back to the farm it came from.

Consumer desire for transparency has also seen people turn to local suppliers, such as butchers, farmers’ markets and grocers. Many consumers were looking for locally sourced products with a lower carbon footprint before Covid-19, and the rise of home working during the pandemic has made it easier for people to shop locally and find out more about where their food comes from.

The Customer-First Approach to Food and Drink Trends

As consumer attitudes and behaviours continue to shift in the aftermath of Covid-19, brand owners and food producers must be the first to recognise and respond to emerging trends. Today’s consumers have more choice than ever before, and if your brand or product doesn’t resonate with them they are likely to look to your competitors.

With many consumers making dramatic changes in the pursuit of a healthier and more environmentally conscious lifestyle, it’s no longer safe to assume that you know your customers and what they want. Even loyal customers are likely to turn away from your brand or product if it doesn’t suit their new lifestyle or address their concerns, leaving your company lagging behind.

In order to remain relevant, brands and food producers must focus on gaining a deeper understanding of the behaviours and motivations of their customers. This intelligence can then be used to inform brand strategy and create products that sell.

Brandspeak’s customer-first approach builds on this understanding, putting customers at the centre of brand and product strategy. By performing intelligent market research to understand customer behaviour and motivations, we’re able to predict trends before they happen and provide high-level data to inform and guide your approach – helping brands to be proactive rather than reactive.

For more information about how Brandspeak can help your food and drink brand stay one step ahead, contact Brandspeak at enquiries@brandspeak.co.uk or on +44 (0)203 858 0052.